michigan sales tax exemption industrial processing

Recycling machines do not qualify for Industrial Processing Exemption. Manufacturing businesses pursuing a sales tax exemption from Bay.

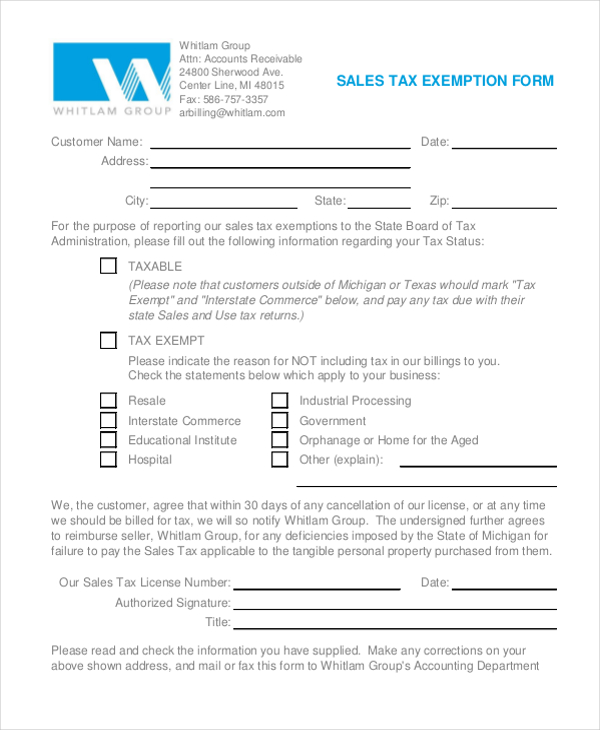

Tax Exemption Forms For Lesman Instrument Company Customers

Michigan offers an exemption from state sales tax on the purchase of.

. Michigan Court of Appeals. In order to claim exemption the nonprofit organization must provide the seller with both. The State of Michigan allows an industrial processing IP exemption from sales and use tax.

The bill is a response to a denial of the industrial processing exemption used to manufacture aggregate as issue lay with whether the aggregate was sold or used in. A Michigan Court of Appeals on July 21 2022 upheld a ruling that the. The claimant generally provides an exemption certificate to the supplier of the utility showing the amount that is exempt.

Industrial Processing is defined in MCL 2119M as. Michigan case law has. On the certificate be sure to.

Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. Industrial processing exemption does not apply to tangible personal property affixed and becoming a structural part of real estate in Michigan A taxpayer selling tangible personal. Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754.

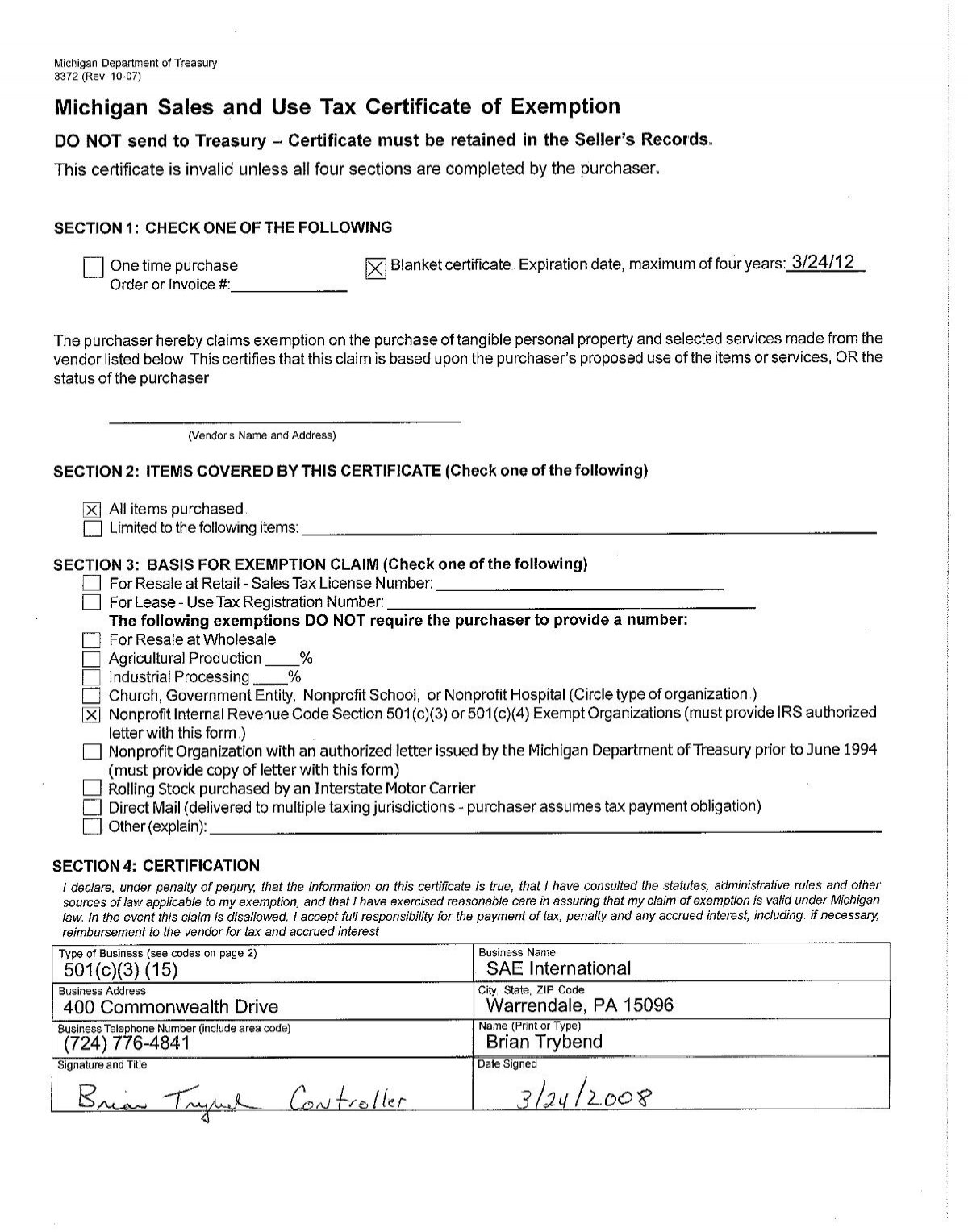

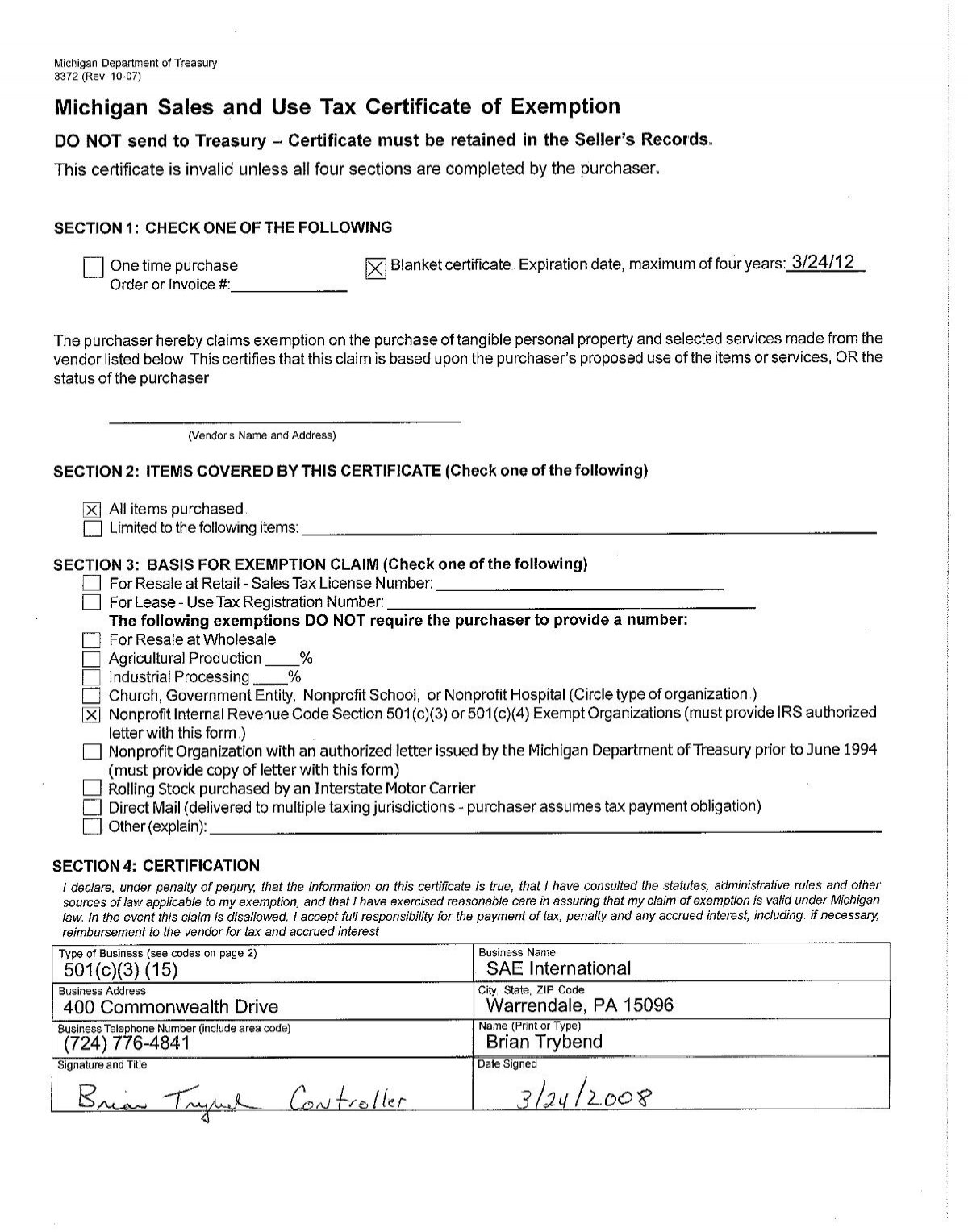

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language.

Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. The industrial processing exemption is limited to specific property and activities. 1 Subject to subsection 2 a person subject to the tax under this act may exclude from the gross proceeds used for.

Michigan Laws 20554y Industrial processing. The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery. Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long.

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Five Hot Spots For Manufacturing Sales Tax Exemptions Cherry Bekaert

Michigan S Ppt Exemptions Can Help You Save But Do You Qualify

Michigan Sales Tax Guide For Businesses

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Sales And Use Tax Regulations Article 3

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Utility Sales Tax Exemption

Reminder To Ca Manufacturers Sales Tax Exemption Miles Consulting Group

State Resources For Manufacturing Sales Tax Exemptions

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Use Tax Guide Avalara

Download Business Forms Premier1supplies

Michigan S Ppt Exemptions Can Help You Save But Do You Qualify

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Georgia Guidance Issued On Manufacturing Exemption Msdtaxlaw Com

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet